Fund Name: EQTY Global Growth II – Fundo de Capital de Risco Fechado

Subscription end date: 2026-08-11

ISIN Code: A-PTSFQHIM0004 / B-PTSFQIIM0003

The EQTY Global Growth II – Fundo de Capital de Risco Fechado Fund is a €30M Private Equity Fund (FCR), regulated by CMVM.

- Fund Size € 30,000,000

- Fund Term 7 Years + 1

- Returns Policy Capital Growth + Dividends

- Management Fee 1,5% per year over capital subscribed

- Target Returns (net) > 8% IRR

- Incentive Structure 20% | 5% Preferred Return to Investors

- Global Custody Account Yes

- Minimum Participation € 150,000

- Golden Visa Requirement € 500,000

- Subscription Fee 1,5% of Invested Capital (one-off)

- Tax Status (Investors): 0% Tax for Non-Residents, 10% Tax for Portugal Residents

- ROI – 5% Preferred Return to Investors with Class A Units, Target 8% IRR

- Brochure – Download

EQTY Global Growth II is best suited for investors with a low to moderate risk appetite who are seeking a balanced strategy focused on capital preservation and long-term capital appreciation. The fund is designed for those looking to diversify their portfolio through exposure to both local and international markets, while benefiting from a professionally managed and fundamentally strong investment vehicle

The investment policy is focused on diversification by sector and geography, which includes International Ventures and PropTech, Serviced Operations (Hospitality, Senior Living & Serviced Work Spaces) and Portugal Private Equity.

- A Globally Diversified Portfolio is allocated to different sectors within the Portuguese economy and across international markets

- Non-Real Estate Fund and Golden Visa qualified

- Portfolio: Operations, PropTech and Venture Capital

- Partnering with market leaders, with diverse exposure, lowering the overall portfolio investment risk

EQTY Global Growth II is a diversified investment fund targeting both international and local opportunities, with up to 40% allocated outside Portugal. It invests across key global markets—including Europe, the U.S., and Asia—via partnerships with a leading Sovereign Wealth Fund and top-tier PropTech firms. The Fund spans sectors such as Private Equity, PropTech and Serviced Operations, offering low volatility and downside protection.

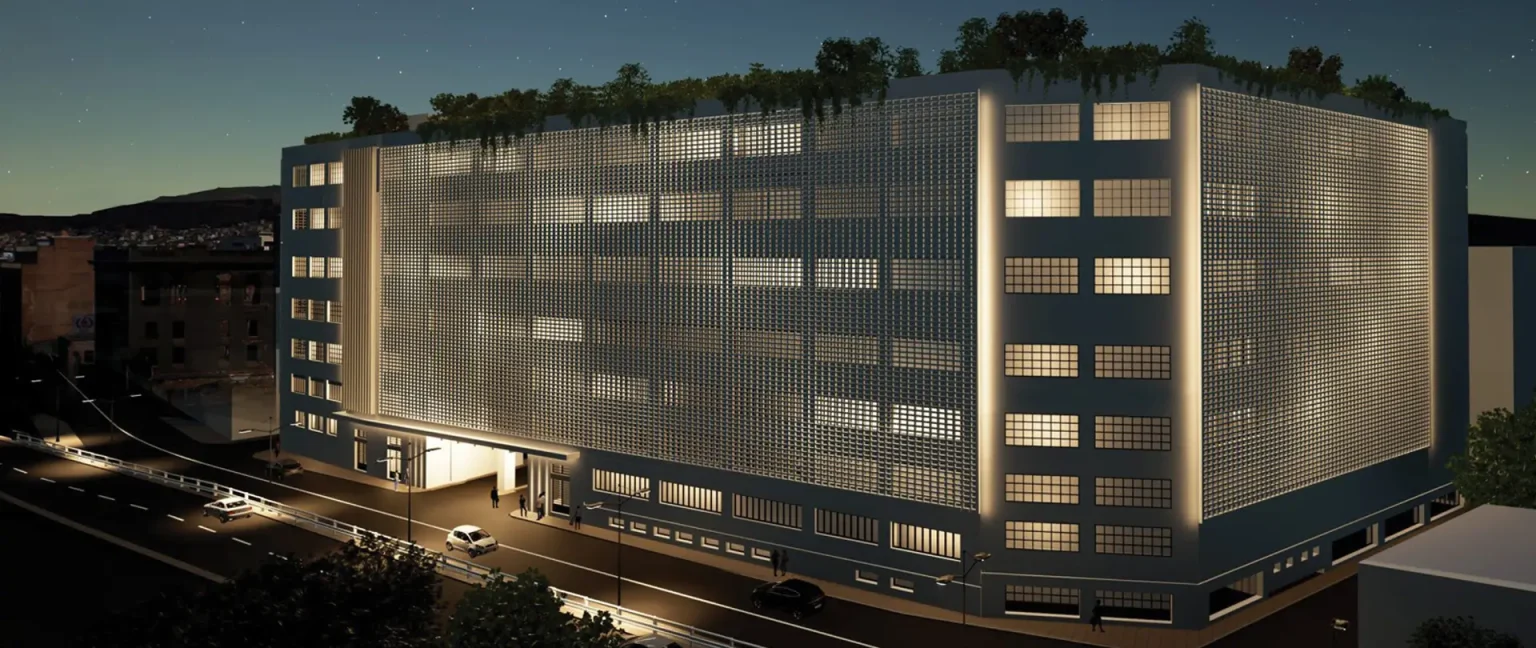

In PropTech, technologies like AI, blockchain, IoT, and big data are transforming everything from construction to property management and transactions — improving efficiency and decision-making in the end to end property lifecycle.

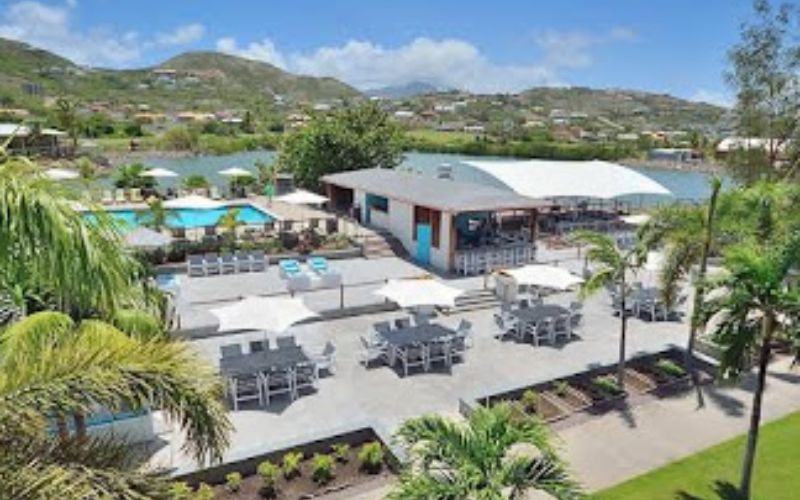

In Serviced Operations, demand is growing for more flexible, experience-led spaces. This includes long-term stays, wellness-focused living, and hybrid workspaces, driven by lifestyle shifts and demographic change.

The Fund is eligible for Golden Visa and may not invest directly or indirectly into Real Estate.

Please Note: this is a Private Equity Fund. It is not guaranteed that capital invested will be reimbursed, or that the Fund will distribute returns. All amounts indicated as returns, are potential returns that may or may not be distributed and may vary in accordance with the Fund’s performance.