Portugal’s Golden Visa scheme’s appeal remains strong among global investors seeking stability and opportunity. Currently investment fund route remains popular among HNWIs seeking a permanent resident status in a stable European country.

Portugal’s Golden Visa program stands as one of the most attractive residency-by-investment initiatives in the world, offering unique benefits to individuals and families seeking a stable and prosperous lifestyle in Europe. Introduced in 2012, this program not only opens the door to European residency but also fosters a pathway to citizenship under favourable conditions.

Capital Green Fund

We now offer our clients a brand new “Capital Green” investment fund in Portugal that offers GV investors buyback and easy exit strategy. It is an innovative credit investment fund strategically designed to deliver consistent financial returns investing in companies with consistent returns while offering the unique opportunity to obtain European residency through the Golden Visa program. With a target size of €25 million, Capital Green III Fund stands out for its prudent risk management, ethical investments, and commitment to ESG principles.

- Asset Manager: FINPROP Capital

- Depository Bank: Bison Bank, ensuring secure and efficient handling of assets.

- Regulator: CMVM (Portuguese Securities Market Commission), ensuring compliance and investor protection.

- Fund Size: €25M

- Auditor: Ernst & Young

- Duration: 10 years, providing a long-term investment horizon.

- Fees: Fully absorbed by Class C units, ensuring transparency and simplicity for other investors.

- Investment Location: Portugal.

- Registered in CMVM under number 2215.

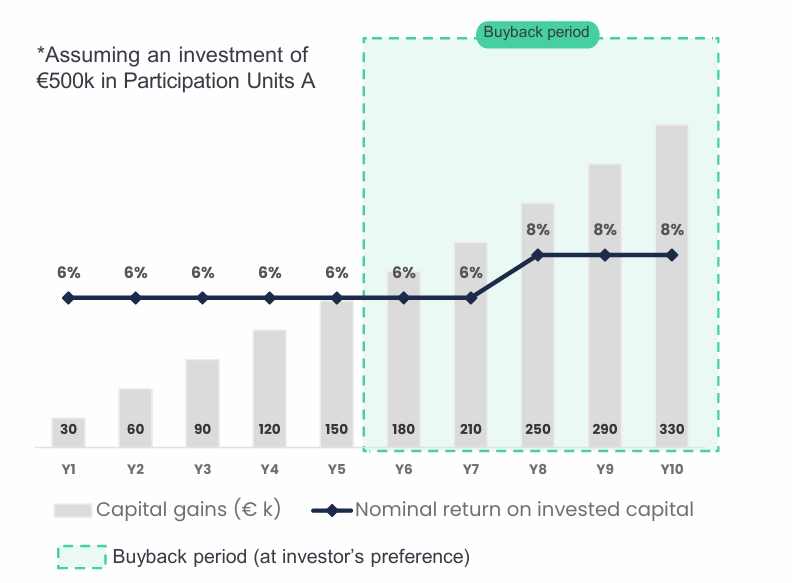

- Returns and Distributions: Preferred distributions of up to 8%. (not guaranteed)

- Non-Residents Tax Rate: 0%, ensuring maximum net returns for international investors.

- Golden Visa – Golden Visa eligibility, the minimum investment requirement is €500,000€

- Buyback – Eligible (not guaranteed under GVP rules)

Exit Strategy

The Fund provide flexible and strategic exit solutions to ensure investor liquidity:

- Put Options: To ensure investor liquidity, the sponsor offers strategic exit mechanisms, including put options for capital redemption following the three years lock-up period.

- Secondary Market Transactions: The fund will remain flexible in providing liquidity to investors through secondary market transactions.

Fund Performance

Refer to the below charg.

Please contact us for more information. We do not charge any fee to our clients. Our consulting services are free of charge to GV investors.