The Permanent Residency Program of Antigua & Barbuda was introduced in 1995 to encourage wealthy individuals to establish tax residency in the country.

Antigua and Barbuda is an offshore jurisdiction with no personal income tax, capital gains tax, inheritance tax and wealth tax. It offers wide range of opportunities for asset protection, including the Citizenship by Investment Program, launched in 2013.

Antigua’s Residency program offers ZERO worldwide income, capital gains, inheritance and wealth tax.

There are two schemes for residence in Antigua and Barbuda

1. Permanent Residence Certificate

The requirements to qualify for Permanent Residency Program of Antigua & Barbuda are as follows:

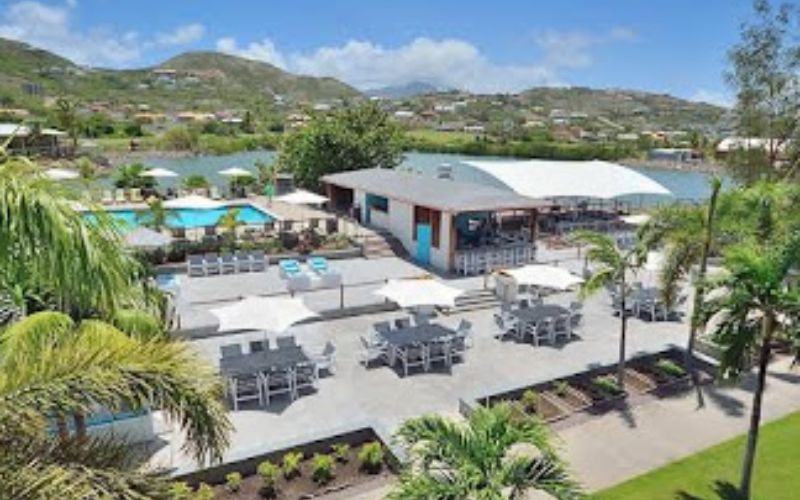

- Maintain a permanent place of abode in Antigua & Barbuda (either leased or purchased);

- Spend at least 30 days a year in Antigua & Barbuda;

- Annual income must exceed US$100,000;

- Pay a flat tax of US$20,000 per annum.

- Purchase or lease of property in Antigua

In case of purchase of property

- Obtain an alien landholding licence costing 5% of the property value in case of purchasing the property,

- Pay a purchaser’s stamp duty of 2.50%,

A qualified applicant will be issued a Certificate of registration as a Permanent Resident of Antigua and Tax Identification Number.

The Permanent Residency certificate is available for all nationals, but it especially useful for the economic citizens of Antigua, who have already purchased a real estate in order to qualify for the Citizenship by Investment Program. The certificate can be useful to prove genuine ties to Antigua when traveling abroad along with the passport.

2. Residence Permit Program

Antigua also launched its new Residence Permit Programme, pursuant to the Immigration and Passport Act 2014. The new programme will replace the status of “Temporary Residence” which was previously issued under the Immigration and Passport Act, CAP 208.

The Residence Permit programme came into effect on the 15th June, 2016 and persons deemed eligible to apply include;

1. Individuals who have been lawfully resident in Antigua and Barbuda for a minimum of four (4) years immediately preceding the date of the application; or

2. Individuals who are married to a citizen of Antigua and Barbuda and are living together as husband and wife for a minimum of one (1) year.

Factors to be considered in assessing the overall suitability of applicants include character, health and criminal history. A period of three years will be granted to successful Applicants. It should be noted that with the Temporary Residence a period of two years was granted.

The Benefits gained from acquiring a Residence Permit includes an Applicant’s ability to live, work or study in Antigua and Barbuda; Holders of a Residence Permit will, however, lose their status if they remain outside of Antigua and Barbuda for six months or more, commit a criminal offence in Antigua and Barbuda or anywhere else or if for some reason is deemed persona non grata by Cabinet.

Please visit Immigration website at www.immigration.gov.ag